Almost another year down and we're seeing one of the best years in real estate. Values have continued to go up here in Roseville. The roseville real estate market has been consistently going up with the influx of buyers from the bay area. As we're in the thick of winter now, the market has took a slow down; however, this is typical this time of year. Buyers should be out now to get a good buy. Come spring time, granite bay and rocklin real estate prices will go up around 5%.

Personally I've been looking high and low for a good income property and it's tough. Much more favorable would be an owner occupied house in Roseville that will rent for around 2,000 a month.

I just found out that our Roseville Re/Max office has just sold over 415M in sales this year. That's pretty good for 85 agents. Last year we were at 350M. We might have picked up a little, I know I've doubled my business, but you have to account for the rise in prices too.

Back to the market...

I have several clients that are listening to me and holding off from selling right. now. If you're able to wait until spring time, then you should get a better price.

My projection will be that we'll see around 5% appreciation with a downturn in values come 2019. I think the real estate cycle that we're used to every 7 years has been warped and extended to 10-12 year cycles now.

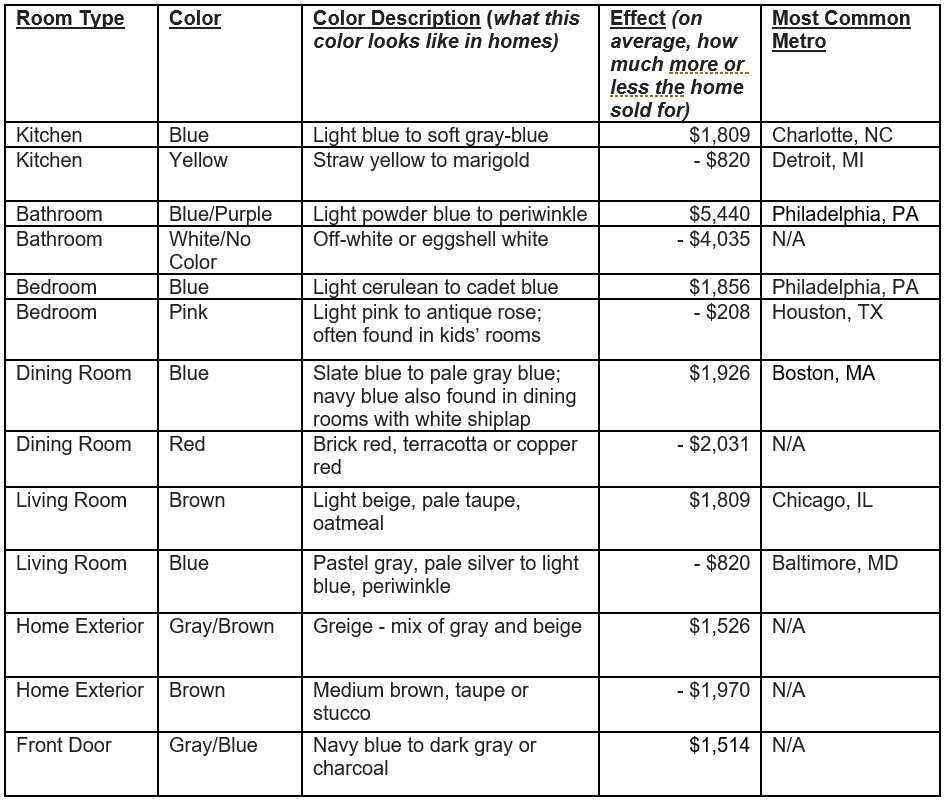

Here's an update put out by realtor.com

New homes are expected to be a “primary driver of sales in 2018,” as 1.33 million housing starts are predicted next year—up from 1.22 million in 2017, according to Freddie Mac’s September Outlook report, which gauges future real estate activity. Total home sales are expected to increase about 2 percent from 2017 to 2018, according to the report.

Economists also predict that the uptick in housing starts, coupled with a moderate increase in mortgage rates, will help slow the run-up in home prices next year. Freddie Mac forecasts a 4.9 percent increase in home prices in 2018, lower than the 6.3 percent growth seen so far this year. Mortgage rates also are up from near-record lows in 2016, prompting predictions that refinancings will fall to 25 percent of mortgage activity in 2018—the lowest share since 1990, according to Fannie Mae.

Still, homeowners likely will continue building equity next year. In the second quarter of 2017, the dollar volume of equity cashed out was $15 million, up $1.2 million from the first quarter. As home prices rise, cash-out activity has been rising, too.

“The economic environment remains favorable for housing and mortgage markets,” says Freddie Mac chief economist Sean Becketti. “For several years, we have had moderate economic growth of about two percent a year, solid job gains, and low mortgage interest rates. We forecast those conditions to persist into next year.”